When you own a commercial vehicle like the Tata Ace, it is crucial to have adequate insurance coverage to protect it from unforeseen events. Tata Ace Insurance Third Party coverage is an essential insurance policy that every Tata Ace owner must consider. This article will provide an in-depth overview of the benefits and coverage details of Tata Ace Insurance Third Party.

Table of Contents

- What is Tata Ace Insurance Third Party?

- Benefits of Tata Ace Insurance Third Party

- Coverage Details of Tata Ace Insurance Third Party

- What is not covered by Tata Ace Insurance Third Party?

- How to choose the right Tata Ace Insurance Third Party policy?

- Tata Ace Insurance Third Party Claim Process

- Frequently Asked Questions (FAQs)

What is Tata Ace Insurance Third Party?

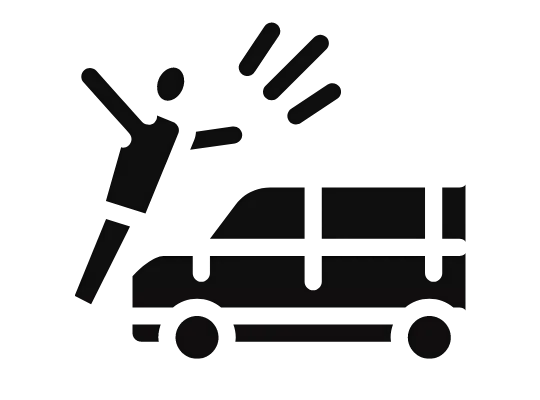

Tata Ace Insurance Third Party is a type of commercial vehicle insurance policy that provides coverage against any third-party liabilities arising out of the use of Tata Ace. The policy covers damages or losses incurred by third parties like bodily injury, death, or property damage in an accident involving the Tata Ace.

Benefits of Tata Ace Insurance Third Party

Here are some of the significant benefits of Tata Ace Insurance Third Party:

1. Legal Protection

Tata Ace Insurance Third Party provides legal protection to the insured against any third-party liabilities arising out of an accident involving the vehicle. It helps the insured to comply with the legal requirements under the Motor Vehicles Act, 1988.

2. Cost-Effective

Tata Ace Insurance Third Party is a cost-effective insurance policy as compared to Comprehensive Insurance. The premium for this policy is relatively lower as it only covers third-party liabilities and not damages or losses to the insured’s vehicle.

3. Peace of Mind

Tata Ace Insurance Third Party provides peace of mind to the insured as it covers any third-party liabilities that may arise in the event of an accident. The insured need not worry about the financial burden of compensating third parties for any damages or losses.

Coverage Details of Tata Ace Insurance Third Party

Tata Ace Insurance Third Party provides coverage against the following:

1. Bodily Injury

The policy covers any bodily injury caused to third parties in an accident involving the Tata Ace. The insurance company will pay for the medical expenses incurred by the third party.

2. Death

In the unfortunate event of death of a third party in an accident involving the Tata Ace, the policy covers the compensation payable to the legal heirs of the deceased.

3. Property Damage

Tata Ace Insurance Third Party covers any damage caused to the property of a third party in an accident involving the vehicle. The insurance company will compensate for the damages caused to the third party’s property.

What is not covered by Tata Ace Insurance Third Party?

Tata Ace Insurance Third Party does not cover damages or losses to the insured’s vehicle. It also does not cover any damages or losses caused due to a natural calamity or any other unforeseen event. The policy does not cover any intentional damage caused by the insured or any illegal activities carried out using the Tata Ace.

How to choose the right Tata Ace Insurance Third Party policy?

Here are some of the factors to consider while choosing the right Tata Ace Insurance Third Party policy:

1. Coverage

Ensure that the policy provides adequate coverage for third-party liabilities. It is essential to read the policy document thoroughly to understand the coverage details.

2. Premium

Compare the premium charged by different insurance companies and choose the one that offers the best value for money.

3. Add-On Covers

Some insurance companies offer add-on covers like personal accident cover for the driver, legal liability to the employees, etc. Consider adding these covers for better protection.

Tata Ace Insurance Third Party Claim Process

In case of an accident involving the Tata Ace, follow these steps to file a claim under the Tata Ace Insurance Third Party policy:

- Inform the insurance company about the accident and provide all the necessary details like the date, time, location of the accident, etc.

- File an FIR with the local police station and obtain a copy of the FIR.

- Take photographs of the accident scene, damages caused to the third party’s property, and any injuries sustained by the third party.

- Collect the details of the third party involved in the accident like name, contact details, and vehicle registration number.

- Submit all the necessary documents like the claim form, FIR copy, photographs, and any other documents required by the insurance company.

- The insurance company will investigate the claim and settle it as per the terms and conditions of the policy.

Frequently Asked Questions (FAQs)

- Is it mandatory to have Tata Ace Insurance Third Party coverage?

Yes, as per the Motor Vehicles Act, 1988, it is mandatory to have at least third-party insurance coverage for commercial vehicles like the Tata Ace. - What is the difference between Tata Ace Insurance Third Party and Comprehensive Insurance?

Tata Ace Insurance Third Party only covers third-party liabilities arising out of an accident involving the vehicle. On the other hand, Comprehensive Insurance provides coverage for damages or losses to the insured’s vehicle as well as third-party liabilities. - Can I add additional covers to my Tata Ace Insurance Third Party policy?

Yes, some insurance companies offer add-on covers like personal accident cover for the driver, legal liability to the employees, etc. - How is the premium for Tata Ace Insurance Third Party calculated?

The premium for Tata Ace Insurance Third Party is calculated based on the gross weight of the vehicle. - How long is the policy period for Tata Ace Insurance Third Party?

The policy period for Tata Ace Insurance Third Party is usually one year, after which it needs to be renewed.

Conclusion

Tata Ace Insurance Third Party is an essential insurance policy that every Tata Ace owner must consider. It provides legal protection and peace of mind to the insured against any third-party liabilities arising out of an accident involving the vehicle. By understanding the benefits and coverage details of Tata Ace Insurance Third Party, you can make an informed decision and choose the right policy for your needs.