Commercial Car/Taxi Insurance

Commercial car/taxi insurance is a type of insurance policy that provides coverage to taxi owners and drivers against financial loss in the event of an accident, theft, fire, or any other unforeseen event that might damage their vehicle or cause injury to third parties.

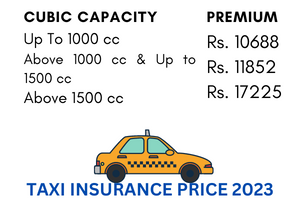

Taxi Insurance Price

The price of third-party commercial car insurance can be as low as ₹10688 and similarly, the price of comprehensive taxi insurance can be as low as ₹16000.

Key Features Of Commercial Car/Taxi Or Cab Insurance

| Key Features | Benefits |

|---|---|

| Damages To Third Parties | TPPD cover up to 7.5 lac & Unlimited for legal liabilities. |

| Covers Damages To Own Vehicle | Up to Sum Insured Of Vehicle |

| Theft Cover | Included in comprehensive policy. |

| Types Of Vehicles Covered | All passenger cars up-to sitting capacity 6 |

| Price | 10688+GST for a third party policy |

Types of Commercial Car/Taxi Insurance

There are two types of commercial car/taxi insurance policies available in India:

Third-party Insurance

Third-party insurance is the most basic form of commercial car/taxi insurance. This type of insurance provides coverage against any damage or injury caused to third parties in the event of an accident. Third-party insurance does not cover any damages to the taxi owner’s vehicle or any injuries sustained by the driver.

Comprehensive Insurance

Comprehensive insurance is a more advanced form of commercial car/taxi insurance that provides coverage against a wider range of risks. This type of insurance covers damages to the taxi owner’s vehicle, as well as injuries sustained by the driver and any third parties involved in the accident. Comprehensive insurance also covers theft, fire, and other unforeseen events that might cause damage to the vehicle.

Third Party Taxi Insurance Price List 2023

| Car Model | Cubic Capacity | Insurance Price (per year) |

|---|---|---|

| Maruti Suzuki Alto | 796 cc | ₹10,688 |

| Tata Indica | 1396 cc | ₹11,852 |

| Hyundai Santro | 1086 cc | ₹11,852 |

| Toyota Etios | 1496 cc | ₹11,852 |

| Mahindra Verito | 1461 cc | ₹11,852 |

| Tata Sumo (7+1) | 2956 cc | ₹19,459 |

| Toyota Innova (6+1) | 2494 cc | ₹17,225 |

| Mahindra Xylo (6+1) | 2489 cc | ₹17,225 |

| Maruti Wagon R | 998 cc | ₹10,688 |

| Maruti Swift | 1197 cc | ₹11,852 |

| Maruti Swift Dzire | 1197 cc | ₹11,852 |

| Maruti Ertiga | 1462 cc | ₹13,808 |

| Hyundai Xcent | 1197 cc | ₹11,852 |

Benefits of Commercial Car/Taxi Insurance

There are several benefits of having commercial car/taxi insurance in India, including:

- Protection from Financial Liability: In the event of an accident, commercial car/taxi insurance can provide financial protection from liability for damage to property, injuries to passengers, or injuries to third parties.

- Legal Compliance: In India, it is mandatory to have at least a third-party insurance policy for commercial vehicles. Failing to comply with this requirement can result in fines, penalties, or even legal action.

- Coverage for Business Interruptions: Commercial car/taxi insurance policies can also provide coverage for business interruptions due to accidents, theft, or other events that can cause your business to temporarily shut down.

- Peace of Mind: Knowing that your commercial vehicles are adequately insured can provide peace of mind and allow you to focus on running your business without worrying about potential financial losses.

- Competitive Advantage: Having commercial car/taxi insurance can also give your business a competitive advantage, as it can demonstrate to customers that you take their safety and well-being seriously.

Factors to Consider When Choosing Commercial Car/Taxi Insurance

When choosing a commercial car/taxi insurance policy in India, there are several factors to consider, including:

Coverage

It is important to choose a policy that provides adequate coverage against a wide range of risks, including theft, fire, and other unforeseen events.

Premium

The premium for commercial car/taxi insurance varies depending on several factors, including the age and condition of the vehicle, the age and driving record of the driver, and the level of coverage required.

Deductible

The deductible is the amount that the taxi owner or driver is required to pay before the insurance policy kicks in. It is important to choose a policy with a deductible that is affordable and reasonable.

Customer Service

It is important to choose an insurance provider that offers excellent customer service and support. This ensures that taxi owners and drivers can easily file a claim and get the help they need in the event of an accident.

Inclusions & Exclusion Of Commercial Car/Taxi Insurance

| Feature | Third Party Insurance | Comprehensive Insurance |

|---|---|---|

| Damage to third party | Covered | Covered |

| Damage to own vehicle | Not covered | Covered |

| Theft coverage | Not covered | Covered |

| Personal accident cover for driver | Optional | Optional |

| Personal accident cover for passengers | Not covered | Covered |

| Natural calamities | Not covered | Covered |

| Man-made calamities | Not covered | Covered |

| Add-on covers | Not applicable | Available at additional cost |

| Premium cost | Lower | Higher |

| Mandatory requirement | Yes | No |

| Recommended for | Old vehicles or those with low value | New or expensive vehicles |

Taxi Insurance Add-on Features

- Zero Depreciation Cover: This cover ensures that the insurer will not deduct any depreciation on the value of car parts during claims. This add-on is beneficial for new cars or cars with expensive parts.

- Emergency Hotel and Transportation Cover: This cover provides financial support for alternative transportation and accommodation expenses if the insured vehicle breaks down during a journey.

- Personal Belongings Cover: This add-on cover provides compensation for loss or damage to personal belongings kept in the insured commercial vehicle.

- Return to Invoice Cover for New Vehicles: In case of total loss or theft of a new commercial vehicle, this cover will provide the insured with the original invoice value of the vehicle.

- Key Replacement Cover: This add-on cover provides compensation for the cost of replacing the keys of the insured commercial vehicle in case of loss or damage.

- 100% Refund of Vehicle Value in the Event of Total Loss of a New Car: This add-on cover is applicable only for new commercial cars, and it provides the insured with a 100% refund of the vehicle’s value in case of total loss within the first year of purchase.

Optional Covered In Taxi/Cab Insurance

You can enhance your taxi insurance policy by opting for additional covers to ensure the safety of you and your passengers while traveling in the insured vehicle. By paying a nominal premium, you can enjoy the following extensions:

- Personal Accident Cover – This cover provides additional protection in case of accidental death or disability of the policyholder, driver, and co-passengers.

- Electrical & Electronic Accessories – This cover includes electronic and electrical accessories like fog lights, music system, LCD mini TV, and even seat covers.

- Bi-Fuel System Cover – This cover provides protection for the CNG & LPG Kit installed in the commercial vehicle.

How to Compare Taxi Insurance Online?

To compare different commercial taxi insurance policies online and save money while selecting the best coverage options and add-ons, follow these steps:

- Shortlist the type of coverage you want:

- If you only want third-party liability cover, opt for liability insurance only.

- If you want to cover both third-party and own-damage cover, then you can buy a comprehensive taxi vehicle insurance policy.

- Look for add-on benefits:

- Comprehensive plans come with add-ons like nil depreciation cover, no-claim-bonus protection cover, and roadside assistance.

- Compare the IDV quoted by different insurance companies:

- The IDV can significantly affect the commercial vehicle insurance premium amount.

- Compare the claim settlement procedure of each taxi insurance policy:

- Make sure you understand the claims process before buying a policy.

- Compare taxi insurance quotes online:

- Once you have shortlisted the policies and coverage options, compare quotes online to make an informed decision.

Buy Taxi Insurance Online

Buying a taxi insurance policy online is now quick and easy:

- Fill in personal and vehicle information:

- Personal Information of the Proposer: Full name, mobile number, city, area, pincode, email address, other areas (if applicable)

- Vehicle Information: City where taxi was registered (RTO), engine capacity, make, fuel type, model, year of manufacture, seating capacity, type of body, current insurance policy type, IDV, policy term, transfer of ownership (Yes/No), cover for accessories installed in vehicle, NCB applicable

- Generate a taxi car insurance price quote or check taxi cab insurance rates.

Taxi Insurance Renewal Process

To renew a taxi insurance policy online:

- Submit the following information:

- Policy number

- Mobile number

- Registration number or engine number or chassis number

- Click on renew and receive your taxi insurance renewal quote on your ID, which you can download online.

Claim Procedure

To file a taxi insurance claim, make sure you have the following information ready:

- Claim intimation time and date of the accident

- Name of the driver and contact details along with driving license details

- Taxi Insurance Policy number

- Estimated loss

- A brief description of the incident

- Survey location to support the investigation process

- Insured contact details

The following steps need to be taken to file a claim:

- Provide claim intimation at the customer help desk.

- The taxi insurance customer support team will provide you with the claim reference number.

- Upon claim registration, a surveyor will be assigned for your case.

- Furnish all the documents to the assessor, such as vehicle type and severity of the damage.

- Inform about the requirement of the claim processing team to settle own damage claim.

- Coordinate with the surveyor in case of re-inspection of the vehicle is required.

- Claim settlement survey will be done.

Documents Required for Filing a Claim

The following documents are required to file a taxi insurance claim:

- Copy of Police FIR

- Claim form duly signed by the policyholder

- Fitness Certificate for commercial vehicles

- Driving License

- Vehicle Registration Certificate (RC)

- Insurance documents with the endorsement

FAQs

Q: What is taxi insurance? A: Taxi insurance is a type of insurance policy that provides coverage for commercial vehicles used for carrying passengers for hire or reward.

Q: What are the types of taxi insurance policies available in India? A: The types of taxi insurance policies available in India are third-party liability insurance, comprehensive insurance, and third-party fire and theft insurance.

Q: Is taxi insurance mandatory in India? A: Yes, taxi insurance is mandatory in India as per the Motor Vehicles Act, 1988.

Q: What does third-party liability insurance cover? A: Third-party liability insurance covers the damages or injuries caused to third-party individuals or properties due to an accident involving the insured taxi.

Q: What does comprehensive insurance cover? A: Comprehensive insurance covers the damages or injuries caused to third-party individuals or properties as well as the damages or theft of the insured taxi.

Q: What does third-party fire and theft insurance cover? A: Third-party fire and theft insurance covers the damages or injuries caused to third-party individuals or properties as well as the damages or theft of the insured taxi due to fire or theft.

Q: What factors affect the premium of taxi insurance? A: The factors that affect the premium of taxi insurance include the age and make of the vehicle, the usage of the vehicle, the driver’s age and experience, the location of the vehicle, and the type of insurance policy.

Q: What is the claim process for taxi insurance? A: The claim process for taxi insurance involves informing the insurance company about the incident, submitting the necessary documents, and cooperating with the insurance company during the investigation process.

Q: How can I reduce the premium of my taxi insurance? A: You can reduce the premium of your taxi insurance by installing safety and security devices in your taxi, maintaining a good driving record, choosing a higher voluntary deductible, and renewing your policy on time.

Q: Can I transfer my taxi insurance policy to a new owner? A: Yes, you can transfer your taxi insurance policy to a new owner by informing the insurance company and submitting the necessary documents.